1 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month. Your limit will be displayed to you within the Chime mobile app. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions.

You can connect your existing bank account to transfer funds or set up direct deposit You can also login to online banking at chime.com when you need it. The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month. The savings account pays a competitive rate and Discover offers a suite of other products and services. They don't offer a lot of account options, but if their spend and savings accounts meet your needs, we recommend them. You'll find a competitive rate and a top-notch digital experience (as you'd expect!).

Online banking is generally available from two different types of financial institutions. First, almost all traditional banks (with brick-and-mortar branches) offer an online banking option, be it through a website, a mobile app, or both. Second, a growing number of online-only banks have been changing the financial landscape in recent years.

The service welcomes customers with spotty credit histories and doesn't require a credit check. It has no monthly fees and keeps other charges to a minimum. Chime is an online bank that provides free checking and savings accounts accessed via mobile app or web browser. Besides helping you avoid typical bank fees, Chime comes with useful new options like early direct deposits and automatic saving.

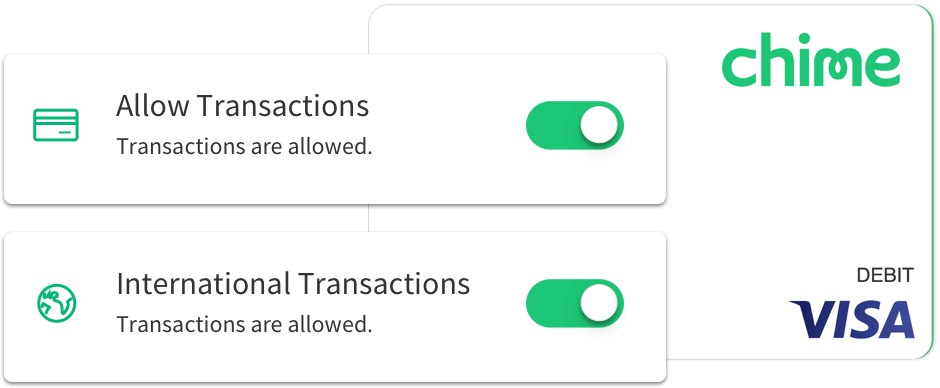

While you won't find products like credit cards or loans available at Chime, it's still a cost-effective alternative for anyone who just needs basic checking and savings. That's why Chime offers online banking with no monthly fees or open deposit required. Applying for a Chime online bank account is completely free. There's no opening deposit or minimum balance required, no international transaction fees, and if you lose your debit card, the new one's on us.

This bank has no monthly fees or minimum balance requirements for its checking or savings products. Customers have access to an extensive ATM network and automatic savings tools. You may even receive your paycheck up to two days early with direct deposit. Like TransferWise, even Paysend is an amazing choice while making international payments. It does not charge anything when you transfer funds to your bank account – even to a foreign bank.

This cash app sends the money to the receiver as soon as you start the payment. Paysend also has an option to send money from one card to another but the app charges a fixed rate of $2. And both banks provide a mobile app that you'll use to manage your bank account, transfer funds, and deposit checks.

However, Chime provides customer service through its app, while Varo doesn't offer this option. Chime's digital banking services include a checking account and savings account. So it's easy to open a bank account and get started, and you won't get stuck with any of the fees most banks charge. And Chime accounts are FDIC-insured for up to $250,000, so you'll know your money is safe. Chime offers fee-free overdraft protection to depositors with more than $500 in monthly direct deposits.

Once upon a time, features like mobile check deposit were considered cutting edge. Now, consumers have come to expect that kind of functionality, along with seamless money transfers, bill pay, ATM locators and more. Today, some apps will even let you track accounts from different financial institutions. Others offer built-in financial wellness and budgeting platforms.

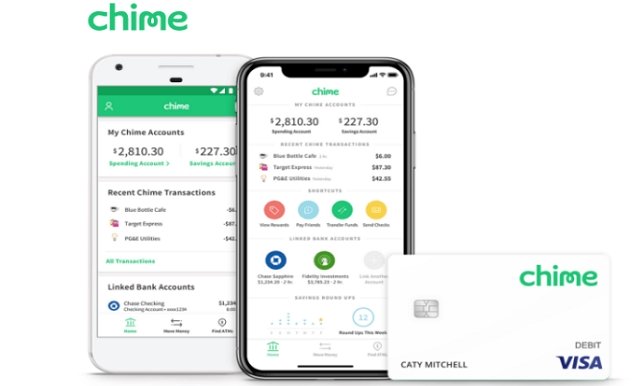

If mobile offerings are a deciding factor for you in choosing a bank, we've assembled this list of the best banking apps on the market. A lot of banks offer a full slate of account options, various options that can make it difficult for you to determine which is best for your needs. However, Chime keeps it simple with one checking account, one savings account and one secured credit card, all in one attractive mobile app. Both banks offer a fee-free checking account for deposits and spending.

In both cases, you'll automatically apply for this account when you set up your account in the app . You can fund it through direct deposit or transferring money from an external bank account. It also offers cash advance loans and is developing a credit builder program called Varo Believe for qualifying customers. Some of these mobile banking options are available only through the app, while others are banking apps that complement online access. You can use Chime services through a mobile app or on a computer through the Chime website.

One of the main features touted by Chime is that it lets youget paid 2 days earlythrough direct deposits sent by your employer. This is compared to traditional banking policies and paper check deposits made by employers or government agencies that send you money, such as your paycheck or monthly benefits. The move comes shortly after Chase began dangling 60,000 rewards points to get more well-heeled young people to sign up for a premium checking account. Finally, Chime's low daily transfer limit and no-cash deposit policy pose problems for two different groups of potential users.

The bank's inability to process cash deposits is a dealbreaker for the small percentage of workers who don't get paid by check or direct deposit. While the lack of cash deposits is common among online banks, Chime's low in-app transfer limit is more unusual. You can avoid the limit by using your other bank's app to make transfers, but it still reduces Chime's usefulness if you don't plan on setting up direct deposits to the Spending Account. At their core, Chime's account features replace branch-based banking with a more agile web-based experience. Instead of having to visit a physical bank to manage accounts, Chime users can carry out all the same tasks from the company's website or mobile app.

Activity monitoring, direct transfers, and mobile check deposit are all available through Chime's Spend Account. Send money instantly to friends using our mobile banking app. Our Pay Friends feature allows you to send fee-free mobile payments to friends or family when they open an account with Chime. No transaction fees or monthly fees for sending payments. This next option is a rewards-earning online checking account. Discover has a Cashback Debit pays you 1% back on debit card purchases.

This bonus applies to the first $3,000 in monthly debit card purchases. One has a checking and savings account that has no monthly fees or minimum balance required. It can earn you 1% APY up to $5,000 and 3% APY on up to 10% of your direct deposit. It's a financial technology company offering banking services through other partner financial institutions.

However, you can still open a Chime Spending Account, Chime Credit Builder Account or even a Chime Savings Account. Chime also offers the Chime card, to make spending and withdrawals just as easy as if you had a regular bank account. We've got all you need to know - including up-to-the-minute Chime reviews - right here. Varo and Chime offer features and benefits that are quite similar in many ways, so you can't really go wrong either way. For example, both banks offer free checking and savings accounts.

And neither charges any monthly maintenance fees, overdraft fees, or minimum balance fees. Chime operates an app that allows its users to create checking and savings accounts, as well as offering a debit card in partnership with Visa. Instead of charging account fees, Chime makes money by taking a portion of the transaction fees that Visa charges merchants when customers use Chime's debit card. Traditional banks are playing catching up with mobile banks, but that doesn't mean they should be dismissed. Many established banks and financial institutions have mobile apps for financial management on the go. Case in point, Discover offers online and mobile banking, various accounts, no account fees, no insufficient funds or overdraft charges, no minimum balances, free ATM withdrawals, and more.

Finally, both the Ally Interest Checking Account and Online Savings Account earn a stronger rate than Chime's Savings Account. Finally, keep an eye out for for high-yield savings accounts, low fees, or early direct deposit features when shopping for a banking app. You want the app to be attached to a bank that offers products and features you want.

If you don't like to carry your card around or often forget to bring it with you, the PNC mobile banking app may be right for you. While some banking apps let you use your phone as your debit card, PNC Bank extends access to your credit and SmartAcess Cards. With this app, you'll never have to worry about not being able to make a purchase because you misplaced or lost your card. Varo boasts two automatic savings features called Save Your Pay and Save Your Change. The former will let you set up the transfer of a predetermined percentage of every direct deposit to your savings account. On the other hand, the latter feature will round up every transaction you make with your account and send that change to your savings balance.

Our banking app sends you daily bank account balance notifications and instant transaction alerts anytime you use your debit card. App notifications make sure you always know where you stand so you can make better informed decisions with your money. Customers of online banks can initiate transactions online, through a mobile app, by phone or by mail. They also can link online bank accounts with accounts they have at traditional banks, credit unions or other online banks. Bank5 Connect offers a checking account, savings account and CDs with terms from six months to 36 months. The mobile app gets 5 stars out of 5 on the App Store and 4.3 out of 5 stars on Google Play .

Rates at BankFive may be higher or lower than rates at Bank5 Connect, depending on the product you choose. Quontic Bank offers one savings account, three checking accounts, a money market account and five CDs with terms ranging from six months to five years. Quontic recently launched its Bitcoin Rewards Checking account, only available in select states so far. The mobile app gets 4.5 stars out of 5 on the App Store and 3.4 stars out of 5 on Google Play. Quontic offers competitive APYs across its other products, along with low minimum deposit requirements and access to 90,000+ surcharge-free ATMs throughout the U.S.

Quontic customers get all the features you may expect from a digital bank, including 24/7 access to online banking and a highly rated mobile app. Axos offers five different checking accounts, one savings account, one money market account and CDs with terms that range from three months to five years. Its mobile app gets 4.7 stars out of 5 on the App Store and 4.4 stars out of 5 on Google Play. Because Ally has no physical locations, it has made it a point to develop its mobile banking app to the point where it is very easy to manage your money. You can use the app to find access to cash-back locations and receive ATM fee reimbursement as needed.

Ally is also good for transferring money between Ally and non-Ally accounts using Zelle. This can help you get your money in a more convenient place if needed. Chime offers some smart account solutions for people who want to manage their money online and on the phone. You won't find as full a range of account types with Chime as you may at your regular bank or credit union - but the fees are probably lower with Chime. One thing that makes Chime different to many banks and other financial institutions is that the way Chime screens customers is different.

This may make it easier to get an account with Chime if you don't have the best of credit scores or if you're just building your credit history. In recent years, online-only financial companies have been springing up at a rapid pace. There are many pros and cons to using an online service to replace your bank. On one hand, they lack many of the fees of traditional banks. At the end of the day, some consumers will get more out of banking apps than others. But Chime's banking app — which is one of the biggest — is starting to sound like more trouble than it's worth.

Simple's spending account is an FDIC-insured checking account with no minimum balance requirements or maintenance fees. Like Chime's, Simple's spending account comes with a chip-enabled Simple Visa® Debit card accepted in millions of locations worldwide. Chime offers SpotMe, which is an alternative to bank overdrafts. SpotMe lets you make debit card purchases that overdraw your account with no overdraft fees.

Varo offers a no-fee overdraft of up to $50 to eligible customers for purchases or withdrawals made with the Varo Visa Debit Card. Current Bank offers free overdraft protection up to $100. A savings account is a bank account where you can store money you don't need right away while having easy access to funds. A checking account is a bank account that allows you to conduct everyday financial activities, such as deposits, withdrawals, bill payments, and recurring payments. A current account typically doesn't attract interest but may receive if it maintains a minimum amount as set forth by the bank, for example, $25,000. The debit card can be used normally for purchases and free ATM cash withdrawals, but Chime's best feature is its mobile app.

The Chime app lets you manage all your banking from a smartphone, whether you feel like going over your recent debit purchases, paying friends by Venmo, or making a mobile check deposit. Combined with Chime's paperless statements, this effectively eliminates paperwork and signatures from your daily banking experience. The world of mobile banking is an ever-expanding one, and you can bet that consumer demand will drive its future. You can also count on tech-focused banks to invest heavily in improving their products. But with so many options out there, you have to ask yourself what you really want out of a banking app. Do you like access to multiple accounts and being able to turn your phone into a digital wallet?

What about being able to trade stocks and make other investments? Whatever feature you find most appealing, there's an app for you. The online bank you choose depends heavily on the products you need. Some online banks are full-service financial institutions, offering checking, savings, money market accounts, CDs and other products.

The Capital One mobile banking app has been rated #1 for satisfaction by J.D. Part of the reason is due to the fact that this app is very easy to use. You can easily check your balances, use Zelle to make digital payments and transfer money, and manage other aspects of your finances.

With this mobile banking app, you can also automatically save every time you get paid. You can also see automatic savings when spending using your Chime Visa Debit Card. Your purchases are rounded to the nearest dollar, and the difference is deposited into your savings. More is likely to come as fintechs try to muscle into traditional banking territory. This month, mobile bank Varo received conditional approval from the federal government to become a national bank of its own. Fintechs typically partner with existing banks to offer checking and savings account services.