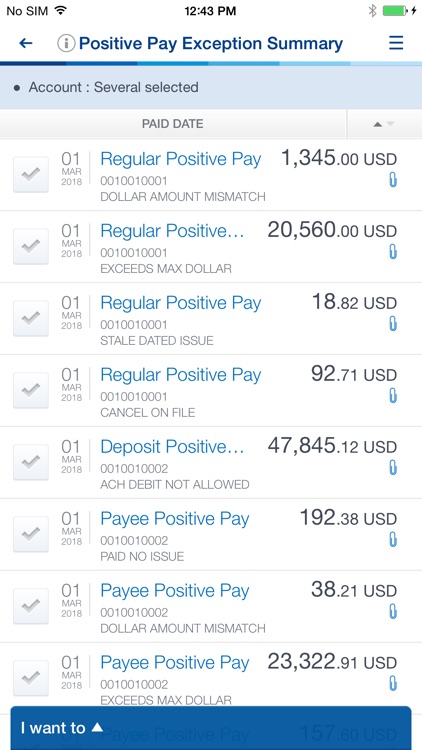

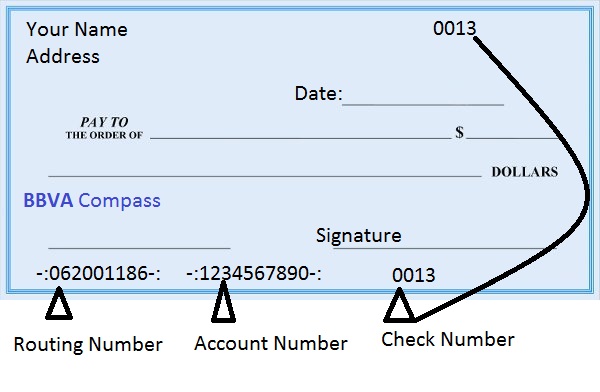

BBVA Compass RealTime ARP provides an overview of check and electronic transaction activity as it happens in real time and automates the check reconciliation process. A customizable dashboard provides a consolidated view of items as they post to accounts. Reporting features allow users to create detailed reports using both the BBVA Compass net cash online platform and mobile app. The first free checking account doesn't have any monthly maintenance fees attached but does require a minimum deposit of $25 to open. Each free checking account owner receives one debit card, bill payment options, and free unlimited check writing, plus access to the mobile app .

Welcome to BBVA Net Cash USA, our powerful treasury management online banking platform that helps you manage your company's financial activity easily and securely. Videos you watch may be added to the TV's watch history and influence TV recommendations. Then sign on with your BBVA Net Cash USA credentials and selected security authentication method.

Please note that your Corporate Administrator must permit your user ID to use this mobile app. There is no advisory fee or commissions charged for Schwab Intelligent Portfolios. Investors in Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium (collectively, "Schwab Intelligent Portfolios Solutions") do pay direct and indirect costs. These include ETF operating expenses which are the management and other fees the underlying ETFs charge all shareholders. The portfolios include a cash allocation to a deposit account at Schwab Bank FDIC-insured Deposit Accounts at Charles Schwab Bank ("Schwab Bank"). Schwab Bank earns income on the deposits, and earns more the larger the cash allocation.

The lower the interest rate Schwab Bank pays on the cash, the lower the yield. Some cash alternatives outside of Schwab Intelligent Portfolios Solutions pay a higher yield. Deposits held at Schwab bank are protected by FDIC insurance up to allowable limits per depositor, per account ownership category. A Schwab affiliate, Charles Schwab Investment Management, receives management fees on those ETFs. Schwab Intelligent Portfolios Solutions also invests in third party ETFs. Schwab receives compensation from some of those ETFs for providing shareholder services, and also from market centers where ETF trade orders are routed for execution.

Fees and expenses will lower performance, and investors should consider all program requirements and costs before investing. Expenses and their impact on performance, conflicts of interest, and compensation that Schwab and its affiliates receive are detailed in the Schwab Intelligent Portfolios Solutions disclosure brochures. At its core, BBVA Compass is a streamlined and simplified banking service that provides a few basic checking and savings account types, a variety of loan options, and a robust mobile app experience. BBVA Net Cash helps you deliver on your treasury management goals. Our online portal lets you monitor and manage your account and transaction activity anytime, from anywhere. You can initiate wire and ACH payments and transfer funds between accounts.

Other capabilities include viewing and downloading detailed reports in a wide range of customizable formats, processing stop payments or check inquires, real-time prevention of check and ACH fraud, and more. Plus, you can do it all while on the go with our award-winning BBVA Net Cash Mobile app. BBVA Net Cash USA helps you stay on top of your company's cash position and banking transactions, even when you are out of the office. Using a secure connection, you can track account balances and activity and execute cash management transactions quickly and accurately.

4Touch ID is available only for newer iPhone models using iOS 8 or higher. Use of your Mobile device requires enrollment in Online Banking and download of our Mobile App. Wireless carriers may charge fees for text transmissions or data usage. Mobile Banking requires an internet-ready phone and is supported on Apple iPhone devices with iOS 9 and greater and on Android mobile devices with OS 5 and greater. Mobile deposits made before 7 pm PT will be processed the same business day and made available within two business days. Longer delays may apply based on the type of items deposited, amount of the deposit, account history or if you have recently opened your account with us.

You can also get help on BBVA's website, which does a good job of highlighting its various accounts and fees — and how to avoid them. The bank also offers other customer service avenues, including Twitter and chat. BBVA has online accounts that are worth a look, with access to thousands of ATMs, including locations in Puerto Rico, Canada, Mexico, the United Kingdom and Australia. The bank also offers some helpful money management tools and highly rated mobile apps, but savings rates are low. In the U.S., BBVA is a Sunbelt-based financial institution that operates 642 branches, including 330 in Texas, 89 in Alabama, 63 in Arizona, 61 in California, 45 in Florida, 37 in Colorado and 17 in New Mexico.

The bank ranks among the top 25 largest U.S. commercial banks based on deposit market share and ranks among the largest banks in Alabama , Texas and Arizona . In the U.S., BBVA has been recognized as one of the leading small business lenders by the Small Business Administration and ranked 8th nationally in terms of dollar volume of SBA loans originated in fiscal year 2018. Industry recognitions for the bank also made headlines last month, including BBVA USA Chief Talent & Culture Executive Rosilyn Houston's recognition from American Banker as one of the Top 25 Most Powerful Women in Banking.

Under her leadership, Houston has worked to boost diversity, employee engagement, benefits programs and recruitment initiatives. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. ETFs at Charles Schwab & Co., Inc. ("Schwab") can be traded without a commission on buy and sell transactions made online in a Schwab account.

Schwab does not receive payment to promote any particular ETF to its customers. Schwab's affiliate Charles Schwab Investment Management, Inc. ("CSIM") serves as investment advisor to the Schwab ETFs™, which compensate CSIM out of the applicable operating expense ratios. The amount of the fees is disclosed in the prospectus of each ETF. This fee will vary, but typically is an asset-based fee of 0.10% per annum of the assets held at Schwab. Options trades will be subject to the standard $.65 per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5).

Exchange process, ADR, foreign transaction fees for trades placed on the US OTC market, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules. Multiple leg options strategies will involve multiple per-contract fees. BBVA bank offers checking and savings accounts, credit cards, wealth management, and other financial services for individuals and businesses.

It's an ideal banking institution if you prefer doing most of your banking by mobile app and don't need really high interest rates for your savings account. It may also be a good choice if you like having a large, accessible ATM network to avoid paying extra fees. "When it comes to online banking in a competitive digital environment, easy, secure access and streamlined functionality are key," said Director of eBanking Channels for Corporate & Commercial Banking Margaret MacLeod. Access your accounts on the go when you download the BBVA Net Cash Mobile USA app. You determine the online treasury management accounts and reports your users can view.

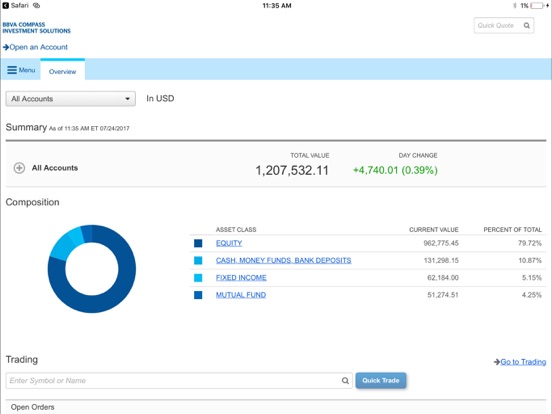

In addition, BBVA Compass net cash™ is the point of access for two new industry-leading services that were launched in July, BBVA Compass RealTime Positive Pay™ and BBVA Compass RealTime ARP™. BBVA Compass net cash™ facilitates the payment initiation process, allowing clients to create multiple payments types on both a one-time and recurring basis from a single screen with only a few clicks. Clients can define specific user permissions, ensuring security in creating and approving payments.

The system also allows users to view and download account and transaction data in a robust range of formats, as well as to integrate reports with their own in-house accounting systems. Ultimately, BBVA Compass is a high-quality banking institution that has evolved quite well with the times and now represents one of the best online banking experiences in the country. For that reason, we recommend this bank for folks who prefer doing most of their banking from afar or using a mobile app, as BBVA Compass's Wallet App has almost every feature or function you can imagine needing.

The first two, you should note, are designed for customers who live near physical branches. The primary online bank account is open to anyone in the country, however. It's perfect for folks who don't mind doing most of their banking online or who need something easy to jump into without high minimum account balances or fees and enough products and services to meet most people's needs.

BBVA Compass stands above many of the others thanks to its excellent mobile app, accessible online banking options, and lack of regular fees or minimum balance requirements. Predictions show that the total number of online and mobile banking users will exceed 3.6 billion by 2024. This has led to some intense competition for online banking customers. The interest rate on the BBVA Online Savings account is low compared with what you can find from other high-yield online savings accounts. You can open an account with a minimum of $25, and if you opt for e-statements, you can avoid a $3 fee charged each quarter. The bank's online money market is another interest-earning account option.

Note that only four withdrawals are allowed per month; it costs $3 per additional withdrawal. Bank of America customer service information is designed to make your banking experience easy and efficient. Get answers to the most popular FAQs and easily contact us through either a secure email address, a mailing address or our customer service phone numbers. BBVA Net Cash USA Mobile was named a winner of Networld Media Group's 2019 Bank Customer Experience Awards, taking first place in the Best Mobile/Online Experience category.

The app is the mobile component of the BBVA Net Cash USA online treasury management platform, which rolled out to customers in 2018. Sign in to various resources, such as online banking, to manage your BBVA personal, business and commercial banking, and wealth management account here. Furthermore, you can do almost everything on the mobile app if you aren't near a physical branch. This includes applying for new accounts and using intuitive digital budgeting tools to help you figure out your finances and plan for long-term financial security. Of all of BBVA Compass's offerings, its mobile app is one of the most beneficial aspects. While the bank has several hundred physical branches and tens of thousands of ATMs, the mobile banking app is truly superb.

The 0.05% APY for the checking accounts above also applies to the savings accounts. Therefore, BBVA Compass is not the best bank when it comes to making your money work for you in the long run. Even so, its accessibility and ease of use make this a good basic online account option for many.

Both accounts incur the above-mentioned $3 for any paper statements per cycle, so be sure to opt out of those ASAP. The benefit of an online savings account is that you can access your funds whenever necessary. BBVA Compass is an accessible bank perfect for folks who like online banking or having a lot of ATMs. It's also one of the best options for people with a less than ideal banking history that is looking for a good second chance checking account. BBVA Compass was one of over 30 banks accused of improperly manipulating customers' checking account transactions to generate excess overdraft fees by posting them in highest-to-lowest dollar amount instead of in chronological order. In July 2012, the bank agreed to pay $11.5 million to settle the lawsuit.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

With BBVA Net Cash USA, you can track account balances and activity plus execute cash management transactions quickly and accurately, even with your mobile device. The security device or mobile token you need to sign operations can be activated in the BBVA Net Cash app. After installing the BBVA Net Cash app, enter the login password you use on the web version. The system will automatically detect that the mobile token is pending activation and will guide you through the process.

Security - Mobile access entitlements coincide with your BBVA Net Cash USA services, accounts, and limit permissions. Users will use the same security authentication method they use for the online channel for mobile login and transaction approvals. Access your overview showing intraday and historical data; consolidate operations in a single currency; check the current and account balances of aggregate accounts; upload and sign payment files. Discover a unique digital experience through a comprehensive view of your accounts. Manage your payments and check the status of all your transactions with total traceability, anytime, anywhere.

Clients can stay on top of payment and reporting activity through both the online portal and the BBVA Compass net cash mobile app, which gives them access to the system's functionality while on the go. BBVA Compass has announced the launch of BBVA Compass net cash™, an updated treasury management portal that helps clients manage their company's cash position and banking transactions. Sign into BBVA Compass Online Banking to access your bank accounts, pay bills, transfer money, and more. BBVA Compass RealTime Positive Pay verifies checks and ACH transactions as they are presented for payment, giving customers information about exceptions as they happen. Users can establish alerts to stay informed about account activity. A dashboard within the BBVA Compass net cash system provides an at-a-glance view of exceptions and allows customers to make pay or return decisions.

A member of Spain's far-reaching Banco Bilbao Vizcaya Argentaria family, BBVA Banco Francés is one of Argentina's largest banks. Founded in 1886, it has some 280 branches that provide corporate, small business, and individual customers with banking services, credit cards, and brokerage services. However, you may want to look elsewhere if you wish to deposit lots of savings into a dedicated savings account and watch that money grow over time.

BBVA Compass's savings account APY is not very impressive and you can find better offerings from many other banks. Alternatively, enter your BBVA Compass mobile app, type the microphone and say clearly "customer service". The app will automatically dial the most appropriate number based on your geographic location. Remember that phone calls are generally limited to business hours in their home state. The only downside to BBVA Compass's online presence is that you can only reach customer service reps by phone instead of through chat. Expect significant delays if you call near the end of business hours.

This minor flaw isn't enough for us to significantly mark BBVA down, however. BBVA Compass provides savings accounts in addition to the selection of checking accounts mentioned above. Provide a minimum deposit of $25 and you'll get access to either a state branch account or an online-only account. Last is premium checking, which is a special account that offers an APY of 0.05% as of 2020.

The account does come with a $19 monthly service charge unless you have an average daily balance of over $4000 in your account or have a monthly direct deposit of the same amount. Still, it can be a good choice if you want to make a little money through your checking efforts. The main online checking account, also called a ClearConnect Checking Account, gives you access to AllPoint fee-free ATMs, everything in the above free checking account, and overdraft protection. We'd recommend turning off paper statements as you'll be saddled with an extra $3 by default otherwise. Interest rates can range from 3.39% up to 12.59% and flexible loan terms range from between 12 and 72 months. If you sign up for a BBVA Compass checking account and have your monthly payments automatically deducted from that checking account, you'll get a 1% rate discount.

All in all, BBVA Compass's auto loans are pretty good and even better than their personal loan option thanks to their accessibility. While BBVA Compass offers several online accounts that are well worth your time and money, there are some minor downsides, such as low overall savings rates. Still, it's a good bank overall if you need something functional and accessible most of the time. Sign into BBVA Online Banking to access your bank accounts, pay bills, transfer money, and more. Consumers who want a large ATM network, prefer banking by mobile app, don't make many savings withdrawals and won't overdraft.